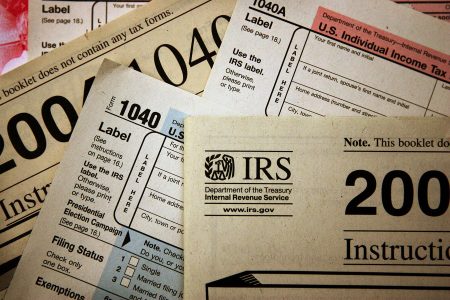

Taxes

There are many tax and estate planning transactions for clients to consider nowadays. While most U.S. citizen clients will only…

In certain instances, taxpayers are required to file information returns with the IRS. For example, companies that pay independent contractors…

A wealth tax is a levy imposed on the net value of held assets, including cash, real estate, investments, and…

Maryland’s digital advertising tax—codified as the Digital Advertising Gross Revenue Tax Act—is in the news again following a recent ruling…

Did you know that your U.S. passport could be denied, revoked, or not renewed if you owe significant back taxes?…

Generally, U.S. persons must file an IRS Form 3520 if they: (i) make transfers to or receive distributions from a…

The IRS has issued a consumer alert after seeing bad advice circulating on social media about several credits, including a…

Ted Peterson of the University of North Texas Ryan College of Business discusses the SALT deduction cap and its potential…

Giving the IRS more time to audit you sounds counterintuitive or even crazy, but it is not. During the IRS…

The theme of the Republican National Convention’s opening night in Milwaukee was “Make America Wealthy Again.” Speakers one after the…