How long have you been budgeting? One month? One hundred months? So long you don’t remember? If you’re new to budgeting, hear this: It takes about three months to get into the swing of things and feel like this budgeting life is a real routine.

But after that, what if the routine gets a little stale? Or what if, no matter how long you’ve been at it, you wonder if you’re missing something?

It might be time for a fresh budget perspective! Don’t worry. We aren’t suggesting a full overhaul. We’re talking about making some small tweaks to make sure your budget—and your money—is working as hard as you are!

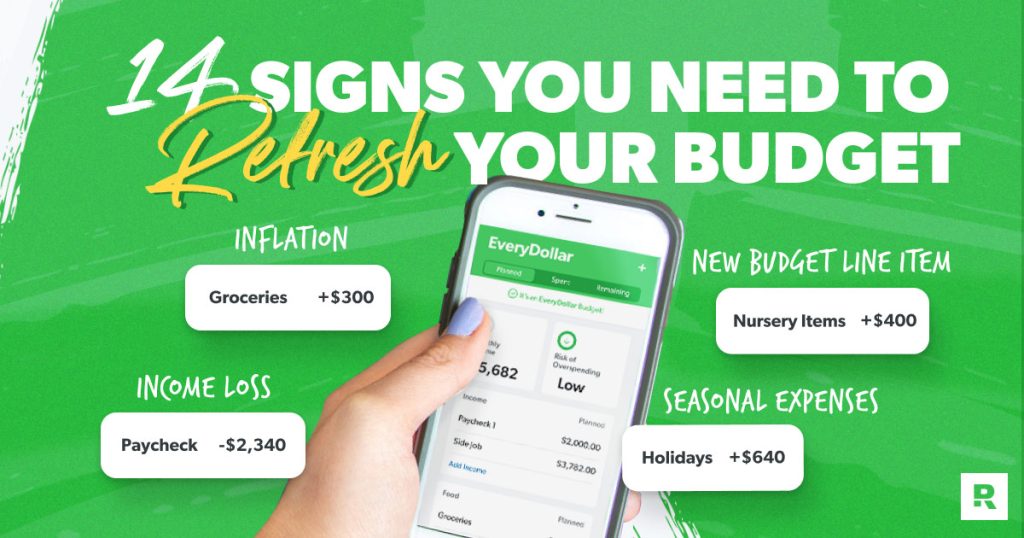

So, how do you know if you should tweak? Check out these 14 signs you need to refresh your budget. If you can relate to any of them, it’s time for a change.

14 Signs You Need to Refresh Your Budget

1. You’re constantly worrying about money emergencies.

Life happens. Worrying about it doesn’t help, but prepping for it does. If you don’t have an emergency fund, create space in your budget to save up and make it happen—stat. This is a top priority in what we call the 7 Baby Steps.

Baby Step 1 is saving $1,000 for a starter emergency fund. Baby Step 2 is getting rid of all debt (except the house—that comes later). And Baby Step 3 is stashing away 3–6 months of expenses into a fully funded emergency fund.

When you’ve got an emergency fund under your belt, you’ll rest easy at night knowing you can handle it if (and when) an emergency pops up. You won’t worry over the next crazy “life happens” moment. You’ll live in confidence with peace of mind, all thanks to that emergency fund.

Pro tip: Check out these ways to save up $1,000. Fast.

2. You use the same exact budget each month.

One of the best ways to stay on top of your money game is to budget before the month begins—every month. That means you can’t use the exact same budget month after month.

Don’t freak out: You don’t have to start from scratch each time. Copy this month’s budget over to the next, and then make changes for the month-specific expenses coming your way. (This is super simple in our free budgeting app, EveryDollar. You’ll just tap last month’s budget over to this month. Then you can tweak and update whatever you need!)

What do we mean by “month-specific expenses” though? These are the things you spend money on one month but not the others—you know: birthdays, tickets to that music festival, holidays or semi-annual expenses like little Harry Pawter’s vet checkup.

Keep your budget fresh each month by scheduling a monthly budget meeting with your accountability partner. If you’re married, that’s your spouse. If you’re not, grab a trustworthy friend or family member who can help keep you on track.

Pro tip: But what do you talk about during this planning time? Check out our Budget Meeting Guide (the classic or couples edition).

3. You aren’t tracking purchases.

A budget is a plan for your money. But don’t set it and forget it. Your goals aren’t a slow cooker, and your budget isn’t either. You can’t dump in numbers, click a button, and walk away.

If you want to stick to your budget, you’ve got to track your transactions. Every time you make a purchase, you need to track it to the right budget line. When you hit the drive-thru, track it to your restaurant line. When you buy flea meds and a lightning bolt sweater for Harry Pawter, track that to your pet line. This shows you where you stand, all month long, so you don’t overspend.

If you aren’t tracking every single transaction, now’s the time to start.

4. You don’t have a budget line for giving.

Make giving a priority—always. Tithing to your church, donating to charities, or supporting worthy causes are important parts of living a fulfilled life. We recommend giving 10% of your income—even if you’re in debt.

Now, it may sound crazy, but being a blessing to others is the only way to truly live like no one else. Generosity shifts the focus off of us. It frees us up to think about others and appreciate what we do have. Contentment doesn’t come when we have enough—it comes when we see that what we have is enough. And giving is a great way to create that contentment.

5. You overspend in one category. A lot.

If you’re overspending in one part of your budget all the time (food, we’re looking at you), something’s got to give. There are two ways to look at this.

First, maybe you aren’t being realistic. You probably can’t set your grocery budget at $300 a month if you’ve got four growing kids. So, find ways to cut back on budget line, like meal planning. (Seriously. It’s a great way to save money here!) Also, adjust your planned amount to a number that makes sense for your life—one that keeps you on track with your money goals but also fits your family’s lifestyle.

Second, you might have an overspending problem. Don’t be ashamed. Do own it. Have a heart-to-heart with the person staring back at you in the mirror.

As you look at your spending, you might notice you have a tendency toward retail therapy, you love filling your closet with new clothing, or you live for a good sale. Hey, this is also a great time to call in that accountability partner.

Once you own the problem, you can make a change and get your budget back on track.

6. You got a raise.

There’s nothing like making more dough—so congrats! But if you just saw that bump in your paycheck, now’s the time to make sure every single one of those new dollars has a job to do.

Now that you’ve got more cash to your name, put it to work so you can reach your goals like getting out of debt or investing. And whatever you do, don’t fall for lifestyle inflation. That’s when you start making more money and then “inflate” your lifestyle to match it. You can kiss that raise goodbye if you do that. So don’t.

7. You lost your job.

The flip side of getting a raise is the reality of job loss. If you lose your job (or even just have a dip in income), first hear this: You will be okay. Yes, this is so very hard. But you will be okay.

You do need to adjust your budget based on the new amount of money you have coming in. Make sure you take care of your Four Walls first—that’s food, utilities, shelter and transportation—and in that order. The goal here is to cover your biggest needs so you can make it to fight another day (and find new work soon!).

If you have any money left in the budget after you take care of your Falls Walls, then make a list of what you need to pay next in order of what’s most important. Focus on sticking to this new budget until you get back on your feet.

And remember: You will be okay.

8. You haven’t updated your budget for inflation.

Let’s be honest—inflation is making things tight right now. Our research shows nearly 85% of Americans say the rising costs have affected their finances. And 40% say inflation is their most pressing financial challenge.

You’re probably feeling it too. But have you adjusted your budget for inflation? You need to get in there, get honest about these rising costs, and make room so you aren’t overspending month after month!

9. You forget annual expenses.

We mentioned annual expenses briefly in point 2, but it’s worth breaking down even more. Because funny enough, it turns out Christmas happens at the same time every year. (It’s December 25, don’t forget!) And that semiannual car insurance payment? Well, you know that’s coming too. And don’t forget about your subscriptions that renew! Those things will really sneak up on you if you’re not careful.

If you’re not budgeting ahead for expenses you know are coming up, it’s time to start. Otherwise you’ll be tempted to jump into debt (no thanks!) or use your emergency fund for something that’s not even an emergency.

Don’t worry, there’s a pretty simple way to remedy this:

- Jot down a list of all your annual and semiannual expenses and their due dates.

- If you think you can afford to cover the expense in the month it’s due, just remember to get it in the budget during your monthly budget meeting!

- If you know it’s too big an expense to cover just that month, then make a sinking fund for each expense—and start stashing away that cash long before the due date comes knocking at the door.

Never heard of a sinking fund before? It’s a simple way to save up cash for a bigger expense, almost like a piggy bank inside your budget. For example, you can set up a sinking fund to make sure you can pay cash for Christmas this year. It’s this simple:

- Divide the total cost you plan to spend by the number of months left before the most wonderful time of the year.

- Put that much in the fund each month.

- You’ll be 100% ready to deck the halls debt-free and cash-ready.

10. You need space for a new budget line item.

If a new expense comes into your life, it needs a spot in the budget. And sadly there’s no budgeting fairy who waves her income wand and makes sure everything balances out. You’ve got to take matters into your own hands and make room.

Let’s say your kid starts tuba lessons (best wishes there) or you sign up for a TV streaming service so you can binge your favorite shows. Those expenses need their own budget lines, and you’ll have to move money from somewhere to cover them. Lower your spending in a couple categories or cut out another budget line completely.

In the end, make sure you’re back to a zero-based budget, and you’ll be good to go.

11. You aren’t budgeting to zero.

Speaking of zero-based—is that how you’re budgeting? No? Well, you should.

Zero-based budgeting works like this: When you add in every source of income and then subtract every single expense (giving, saving, spending), your budget should end up at zero. This doesn’t mean your bank account is at zero. Leave yourself a little buffer of $100–300 there. But no budget should have extra money floating around. That’s how extra money becomes accidentally-spent money. No, thank you.

A zero-based budget gives every dollar a job. Because you work hard for your money—and your money should work hard for you. Every. Single. Dollar.

12. You just hit a Baby Step milestone.

When you pay off a debt (no matter how small) or finish a Baby Step completely, first of all—celebrate! Throw some confetti and be proud of yourself. Any Baby Step milestone is a big deal.

Then, after you vacuum up the confetti mess, refresh your budget and get it prepped for the next goal. If you just wiped out one debt, that means you’ve cleared more cash to add to your debt snowball. Now you can pay even more on the next-smallest debt on your list!

Or maybe you just wrapped your fully funded emergency fund and are ready to tackle investing. Don’t forget to budget for that 401(k) contribution.

Every time you level up in this way, make sure your budget is ready for the next awesome step.

13. Your budget doesn’t line up with your money goals.

Your money goals might be all about paying off debt, saving for vacations, or just getting more breathing room in your bank account. In any case, if your spending habits don’t line up with your money goals, you’ll never make progress.

It might be time for another one-on-one with the person in the mirror. But this time, get hype. “Hey, you! You’ve got what it takes to make your goals happen. But it’ll take work. Let’s get this spending under control, and let’s do this!”

Then take that hype and refresh your budget! You can make those dreams and goals a reality. Believe in yourself. Do the hard work. Stick with it.

It’s worth it.

14. You don’t refresh your budget by the season.

We hit on this some already, but make a point of refreshing your budget with the seasons—and we aren’t just talking about weather, but the common seasons of life that happen in a year.

This will look different for everybody, but here are a couple examples of times you should give your budget some extra attention:

There’s nothing like the dawn of a new year to inspire you to set some goals and make some changes. Fitness goals, career goals and—oh yeah—money goals. Just make sure your budget is ready for all your life goals.

Summertime is famous for bringing a spirit of freedom with it. Live the fun of that freedom by running through sprinklers and spending the evening watching fireflies—not by letting your budget go to ruin.

Plan ahead for the extra expenses of this season, budget for some fun, and then find clever ways to save money in summer so you don’t leave a mess to clean up in August.

Speaking of August, if you’ve got kids, be back-to-school ready. Your kids probably outgrew their clothes over break, so have the budget prepped to get them what they need to start the year off right.

The second October hits, it’s boom boom boom with holiday expenses. You’ve got costumes and bags of candy to buy, ingredients for that turkey and trimmings, and travel costs to go over the river and through the woods.

Again, you know it’s coming. Hopefully you’ve been saving up all year to be cash-ready. But in any case, October’s a great time to start cutting back on normal extras so you can have room for the holiday extras.

It’s Fresh Budget Time

By the way, all this budget refreshing is a whole lot easier when you use our free budgeting tool, EveryDollar. You quickly can set up new budgets every month. Oh, plus you’ll make tweaks and track transactions on the go while using the app. Heck. Yes.

And listen, whenever your budget’s ready for a fresh start, don’t be afraid to jump in and make the changes you need to. Your budget should be about you—your life now and your money goals for the future. Go get it!

Read the full article here